Dozens of cases were reported through the and on , the circumstance that credit cards had been compromised after customers bought a smartphone or some accessories from the OnePlus official website suggests it was compromised by attackers.

Incindent Articles - H 2020 1 2 3 4 5 6 7 8 9 10 Incindent List - H 2021 2020 2019 2018 1 Incident blog Incident blog

Japan-based digital exchange Coincheck to refund to customers after cyberheist

29.1.2018 securityaffairs Incindent

Coincheck announced it will refund about $400 million to 260,000 customers after the hack, the company will use its own funds.

On Friday the news of the hack of the Japan-based digital exchange Coincheck caused the drop in the value of the major cryptocurrencies, the incident had a significant impact on the NEM value that dropped more than 16 percent in 24 hours.

The company suspended the operations of deposits and withdrawals for all the virtual currencies except Bitcoin, the exchange announced it was investigating an “unauthorised access” to the exchange.

According to the company, the hackers stole worth half a billion US dollars of NEM, the 10th biggest cryptocurrency by market capitalization.

The hackers stole 58 billion yen ($530 million), an amount of money that is greater than the value of bitcoins which disappeared from MtGox in 2014.

Coincheck was founded in 2012, it is one of the most important cryptocurrency exchange in Asia.

The company announced it will refund about $400 million to customers after the hack.

Coincheck will use its own funds to reimburse about 46.3 billion yen to its 260,000 customers who were impacted by the cyberheist.

“At 3 am (1800 GMT) today, 523 million NEMs were sent from the NEM address of Coincheck. It’s worth 58 billion yen based on the calculation at the rate when detected,” said Coincheck COO Yusuke Otsuka.

“We’re still examining how many of our customers are affected,”

Experts believe that the Financial Services Agency will to take disciplinary measures against Coincheck.

It has been estimated that as many as 10,000 businesses in Japan accept bitcoin and bitFlyer, nearly one-third of global Bitcoin transactions in December were denominated in yen.The Cryptocurrencies, and in particular Bitcoin, are very popular in Japan, in April, the Bitcoin was proclaimed by the local authorities as legal tender.

According to Japanese bitcoin monitoring site Jpbitcoin.com, in November, yen-denominated bitcoin trades reached a record 4.51 million bitcoins, or nearly half of the world’s major exchanges of 9.29 million bitcoin.

Japanese media criticized the company blaming the management to have underestimated the importance of security of its investor, they said Coincheck “expanded business by putting safety second”.

Politicians and experts that participated in the World Economic Forum in Davos issued warnings about the dangers of cryptocurrencies, it is expected that government will adopt further measures to avoid abuse and illegal uses of cryptocrurrencies.

Japan's Crypto Exchange to Refund to Customers After Theft

28.1.2018 securityweek Incindent

Japan-based virtual currency exchange Coincheck said Sunday it will refund about $400 million to customers after hackers stole hundreds of millions of dollars' worth of digital assets.

The company said it will use its own funds to reimburse about 46.3 billion yen to all 260,000 customers who lost their holdings of NEM, the 10th biggest cryptocurrency by market capitalization.

On Friday, the company detected an "unauthorised access" of the exchange, and later suspended trading for all cryptocurrencies apart from bitcoin.

The resulting 58 billion yen ($530 million) loss exceeded the value of bitcoins which disappeared from MtGox in 2014.

The major Tokyo-based bitcoin exchange collapsed after admitting that 850,000 coins -- worth around $480 million at the time -- had disappeared from its vaults.

The high-profile demise of MtGox failed to douse the enthusiasm for virtual currencies in Japan, which in April became the first country in the world to proclaim it as legal tender.

Nearly one third of global bitcoin transactions in December were denominated in yen, according to specialist website jpbitcoin.com.

As many as 10,000 businesses in Japan are thought to accept bitcoin and bitFlyer, the country's main bitcoin exchange, saw its user base pass the one-million mark in November.

Many Japanese, especially younger investors, have been seduced by the idea of strong profits as the economy has seen years of ultra-low interest rates offering little in the way of traditional returns.

Major Japanese newspapers on Sunday labelled the management of virtual currencies at Coincheck as "sloppy" and said the company had "expanded business by putting safety second".

Local media added the Financial Services Agency was expected to take disciplinary measures against Coincheck, which proclaims itself "the leading bitcoin and cryptocurrency exchange in Asia", following the theft.

Bell Canada Hit by Data Breach

24.1.2018 securityweek Incindent

Bell Canada has started informing customers that their personal data has been compromised in a breach that reportedly affects up to 100,000 individuals.

Bell told customers that their names and email addresses were aaccessed by hackers, but the company said in an emailed statement that the attackers also obtained phone numbers, usernames and/or account numbers for a limited number of people. The telecoms company, however, says there is no evidence that credit card or banking information has been compromised.

In response to the incident, Bell has implemented additional authentication and identification requirements for accessing accounts. The company has also advised users to frequently change their password and security questions, and regularly review their financial and online accounts for unauthorized activity.

“The protection of consumer and corporate information is of primary importance to Bell,” John Watson, Executive Vice-President of Customer Experience at Bell Canada, told customers. “We work closely with the RCMP and other law enforcement agencies, government bodies and the broader technology industry to combat the growth of cyber crimes.”

Lisa Baergen, marketing director with Vancouver-based NuData Security, a Mastercard company, pointed out that even limited information such as names and email addresses can be useful to malicious actors.

“We all know bad actors are very talented at preparing fraud schemes with that information, such as phishing scams or dictionary attacks – where fraudsters try certain common passwords based on the user’s personal information,” Baergen said.

“Bell is doing the right thing by evaluating the extent of the damage and keeping customers updated,” she added. “However, to avoid damage after a breach, companies that share clients with Bell can consider applying multi-layered security solutions based on passive biometrics to protect their business and their customers from account takeover of another type of fraud. Online security technologies that evaluate a user or a transaction based on their behavior and not only on their – potentially stolen – static information, thwart all fraudulent attempts that inevitably come after a data breach.”

This is the second time Bell Canada has informed customers of a data breach. In May last year, the company admitted that approximately 1.9 million active email addresses and roughly 1,700 names and active phone numbers were accessed by a hacker.

Bell told SecurityWeek that the latest incident is unrelated to the cyberattack disclosed in May.

Bell Canada suffers a data breach for the second time in less than a year

24.1.2018 securityaffairs Incindent

Bell Canada is notifying customers about a data breach that exposed personal data of roughly 100,000 individuals, this is the second security breach in a few months.

Bell Canada is notifying customers about a data breach that exposed personal data of roughly 100,000 individuals, including names, phone numbers, email addresses, usernames and account numbers.

“The protection of consumer and corporate information is of primary importance to Bell,” John Watson, Executive Vice-President of Customer Experience at Bell Canada, told customers. “We work closely with the RCMP and other law enforcement agencies, government bodies and the broader technology industry to combat the growth of cyber crimes.”

The Royal Canadian Mounted Police has launched an investigation into the security breach at Bell Canada.

“We are following up with Bell to obtain information regarding what took place and what they are doing to mitigate the situation, and to determine follow up actions,” said the federal privacy watchdog’s spokeswoman Tobi Cohen.

Bell company added that there is no evidence that financial data (i.e. credit card data) has been compromised.

Bell Canada

This the second time that Bell Canada has been a victim of a data breach, in May 2017 an anonymous hacker obtained access to about 1.9 million active email addresses and about 1,700 customer names and active phone numbers.

As part of the incident response procedure, Bell confirmed to have implemented additional security measures, for accounts’ authentication.

Bell Canada advised users to monitor their financial and online accounts for unauthorized activity and recommends customers to use strong passwords and frequently change them.

The Canadian Government plans to review the Personal Information Protection and Electronic Documents Act that would require companies to notify data breaches.

Unfortunately, until now only the province Alberta has mandatory reporting requirements for private-sector companies that suffer a data breach.

40,000 Potentially Impacted in OnePlus Payment System Hack

22.1.2018 securityweek Incindent

Up to 40,000 OnePlus customers may have been impacted after attackers managed to compromise the company’s payment page.

In a Friday post on the OnePlus forums, the Chinese smartphone company confirmed the attack and also revealed that the attackers managed to inject rogue code into its payment page, allowing them to steali credit card information enteredin by users.

The company launched an investigation last week, after some of its users started complaining about fraudulent transactions occurring on their credit cards following purchases made on oneplus.net.

“We are deeply sorry to announce that we have indeed been attacked, and up to 40k users at oneplus.net may be affected by the incident. We have sent out an email to all possibly affected users,” a company’s employee said in a forum post.

The malicious script, the employee revealed, was designed to capture and send data directly from the user's browser. The script has been removed, the compromised server quarantined, and relevant system structures have been reinforced, the company says.

All OnePlus users who entered credit card information on the oneplus.net website between mid-November 2017 and January 11, 2018, may be impacted by the breach. The hack happened around the same time OnePlus 5T, the latest flagship smartphone from the Chinese maker, was launched.

Immediately after being alerted on the incident, the company also suspended credit card payments on its website, but continued to support PayPal payments.

The malicious code injected in the payment page was designed to steal credit card information such as card numbers, expiry dates, and security codes that the users would enter on the website during the compromise period.

According to OnePlus, the incident didn’t impact users who paid via a saved credit card. Users who paid via the "Credit Card via PayPal" method and those who used PayPal to pay should not be affected either.

“We cannot apologize enough for letting something like this happen. We are working with our providers and local authorities to better address the incident. We are also working with our current payment providers to implement a more secure credit card payment method, as well as conducting an in-depth security audit,” the OnePlus employee said.

Not only should enterprises assume they have been or will be breached, but also should savvy consumers assume their financial data is bound to be compromised, Tyler Moffitt, Senior Threat Research Analyst, Webroot, pointed out in an emailed statement to SecurityWeek. Thus, Moffitt encourages users to take steps to be warned when unauthorized transactions occur on their accounts.

“Additionally, when online shopping, it is inherently more secure for consumers to use their PayPal accounts than enter their credit card data upon checkout – it is best practice to enter credit card information as rarely as possible. Most merchants have PayPal, Masterpass or Visa Checkout options available, which are more secure payment protocol alternatives,” Moffitt concluded.

OnePlus admitted hackers stole credit card information belonging to up to 40,000 customers

21.1.2018 securityaffairs Incindent

OnePlus confirmed that a security breach affected its online payment system, hackers stole credit card information belonging to up to 40,000 customers.

OnePlus confirmed that a security breach affected its online payment system, a few days ago many customers of the Chinese smartphone manufacturer claimed to have been the victim of fraudulent credit card transactions after making purchases on the company web store.

OnePlus has finally confirmed that its online payment system was breached, following several complaints of from its customers who made purchases on the company’s official website.

Dozens of cases were reported through the and on , the circumstance that credit cards had been compromised after customers bought a smartphone or some accessories from the OnePlus official website suggests it was compromised by attackers.

On January 19, the company released a statement to admit the theft of credit card information belonging to up to 40,000 customers. The hacker stole the credit card information between mid-November 2017 and January 11, 2018 by injecting a malicious script into the payment page code.

The script was used by attackers to sniff out credit card information while it was being entered by the users purchasing on the web store.

“We are deeply sorry to announce that we have indeed been attacked, and up to 40k users at oneplus.net may be affected by the incident. We have sent out an email to all possibly affected users.” reads the statement.

“One of our systems was attacked, and a malicious script was injected into the payment page code to sniff out credit card info while it was being entered. The malicious script operated intermittently, capturing and sending data directly from the user’s browser. It has since been eliminated.”

OnePlus is still investigating the breach to determine how the hackers have injected the malicious script into its servers.

The script was used to sniff out full credit card information, including card numbers, expiry dates, and security codes, directly from a customer’s browser window.

OnePlus said that it has quarantined the infected server and enhanced the security of its systems.

Clients that used their saved credit card, PayPal account or the “Credit Card via PayPal” method are not affected by the security breach.

As a precaution, the company is temporarily disabling credit card payments at , clients can still pay using PayPal. The company said it is currently exploring alternative secure payment options with our service providers.

OnePlus is notifying all possibly affected OnePlus customers via an email.

“We are eternally grateful to have such a vigilant and informed the community, and it pains us to let you down. We are in contact with potentially affected customers. We are working with our providers and local authorities to address the incident better,” continues the statement.

OnePlus confirms up to 40,000 customers affected by Credit Card Breach

20.1.2018 thehackernews Incindent

OnePlus has finally confirmed that its online payment system was breached, following several complaints of fraudulent credit card transactions from its customers who made purchases on the company's official website.

In a statement released today, Chinese smartphone manufacturer admitted that credit card information belonging to up to 40,000 customers was stolen by an unknown hacker between mid-November 2017 and January 11, 2018.

According to the company, the attacker targeted one of its systems and injected a malicious script into the payment page code in an effort to sniff out credit card information while it was being entered by the users on the site for making payments.

The malicious script was able to capture full credit card information, including their card numbers, expiry dates, and security codes, directly from a customer’s browser window.

"The malicious script operated intermittently, capturing and sending data directly from the user's browser. It has since been eliminated," OnePlus said on its official forum. "We have quarantined the infected server and reinforced all relevant system structures."

However, the company believes users who shopped on its website using their saved credit card, PayPal account or the "Credit Card via PayPal" method are not affected by the breach.

OnePlus is still investigating the incident and committed to conducting an in-depth security audit to identify how hackers successfully managed to inject the malicious script into its servers.

Meanwhile, credit card payments will remain disabled on the OnePlus.net store until the investigation is complete as a precaution, though users can make purchases through PayPal.

"We are eternally grateful to have such a vigilant and informed the community, and it pains us to let you down. We are in contact with potentially affected customers. We are working with our providers and local authorities to address the incident better," OnePlus says.

OnePlus is notifying all possibly affected OnePlus customers via an email and advises them to keep a close eye on their bank account statements for any fraudulent charges or look into cancelling their payment card.

The company is also looking into offering a one-year subscription of credit monitoring service for free to all affected customers.

Customers reporting OnePlus payment website was hacked and reported credit card fraud

17.1.2018 securityaffairs Incindent

Several customers of the Chinese smartphone manufacturer. OnePlus claim to have been the victim of fraudulent credit card transactions after making purchases on the company webstore.

A large number of OnePlus users claim to have been the victim of fraudulent credit card transactions after making purchases on the official website of the Chinese smartphone manufacturer.

Dozens of cases were reported through the support forum and on Reddit, the circumstance that credit cards had been compromised after customers bought a smartphone or some accessories from the OnePlus official website indicating suggest it was compromised by attackers.

“I purchased two phones with two different credit cards, first on 11-26-17 and second on 11-28-17. Yesterday I was notified on one of the credit cards of suspected fraudulent activity, I logged onto credit card site and verified that there were several transactions that I did not make” claims one of the victims. “The only place that both of those credit cards had been used in the last 6 months was on the Oneplus website.”

Security researchers at Fidus analyzed the payment page after reading the claims on the official forum and discovered that card details are hosted ON-SITE exposing data to attacks.

“We stepped through the payment process on the OnePlus website to have a look what was going on. Interestingly enough, the payment page which requests the customer’s card details is hosted ON-SITE.” reads a blog post published by Fidus. “This means all payment details entered, albeit briefly, flow through the OnePlus website and can be intercepted by an attacker. Whilst the payment details are sent off to a third-party provider upon form submission, there is a window in which malicious code is able to siphon credit card details before the data is encrypted.”

The experts speculate the servers of the company website might have been compromised, likely the attackers exploited some flaws in the Magento eCommerce platform used by OnePlus.

There are two methods used by crooks to steal credit cards from Magento-based stores:

Using Javascript on client-side. The malicious JavaScript is hosted on the web page which causes the customer’s machine to silently send a crafted request containing the payment data to a server controlled by attackers. The researchers who analyzed the payment page on the OnePlus site did not find any malicious JavaScript being used.

The second method relies on the modification of the app/code/core/Mage/Payment/Model/Method/Cc.php file through a shell access to the server. The Cc.php file handles the saving of card details on the eCommerce website. Regardless if card details are actually saved or not, the file is called regardless. Attackers inject code into this file to siphon data.

OnePlus declared that it does not store any credit card data on its website and all payment transactions are carried out through a payment processing partner.

“At OnePlus, we take information privacy extremely seriously. Over the weekend, members of the OnePlus community reported cases of unknown credit card transactions occurring on their credit cards post purchase from oneplus.net. We immediately began to investigate as a matter of urgency, and will keep you updated. ” reads the statement published by the company.

“No. Your card info is never processed or saved on our website – it is sent directly to our PCI-DSS-compliant payment processing partner over an encrypted connection, and processed on their secure servers. “

“The Chinese smartphone maker also confirms that purchases involving third-party services like PayPal are not affected.”

OnePlus excluded that its website is affected by any Magento vulnerability, since 2014, it has entirely been re-built using custom code.

Data breach of the Aadhaar biometric system poses a serious risk for 1 Billion Indian residents

6.1.2018 securityaffairs Incindent

The Tribune announced to have “purchased” a service that provided it an unrestricted access to the residents’ records in the Aadhaar system.

According to The Tribune, hackers have breached the Unique Identification Authority of India’s Aadhaar biometric system and gained access to personally identifiable information (i.e. names, addresses, phone numbers) of more than 1 billion Indian residents.

The Tribune announced to have “purchased” a service being offered by anonymous sellers over WhatsApp that provided it an unrestricted access to details for any individual whose data are stored in the Aadhaar system.

Attackers offered a portal to access Indian citizen data by knowing the Aadhaar user’s ID number. The service allowed the journalist to retrieve the resident’s name, address, postal code, photo, phone number, and email address, by providing the Aadhaar ID.

The hackers are offering the access to the portal for 500 rupees and are charging an additional 300 rupees for an application that allows printing a Aadhaar card.

“Today, The Tribune “purchased” a service being offered by anonymous sellers over WhatsApp that provided unrestricted access to details for any of the more than 1 billion Aadhaar numbers created in India thus far.” states The Tribune.

“It took just Rs 500, paid through Paytm, and 10 minutes in which an “agent” of the group running the racket created a “gateway” for this correspondent and gave a login ID and password. Lo and behold, you could enter any Aadhaar number in the portal, and instantly get all particulars that an individual may have submitted to the UIDAI (Unique Identification Authority of India), including name, address, postal code (PIN), photo, phone number and email.”

The Unique Identification Authority of India denies that Aadhaar system has been breached, but The Tribune revealed that when contacted, UIDAI officials in Chandigarh expressed shock over the full data being accessed, and admitted it seemed to be a major national security breach.

“Except the Director-General and I, no third person in Punjab should have a login access to our official portal. Anyone else having access is illegal, and is a major national security breach.” Sanjay Jindal, Additional Director-General, UIDAI Regional Centre, Chandigarh told The Tribune.

According to the investigation conducted by The Tribune, the breach could have involved lakh village-level enterprise (VLE) operators hired by the Ministry of Electronics and Information Technology (ME&IT) under the Common Service Centres Scheme (CSCS) across India, offering them access to UIDAI data.

CSCS operators were initially tasked with making Aadhaar cards across India, but later this function was restricted to post offices and designated banks.

More than one lakh VLEs are now suspected to have gained this illegal access to UIDAI data to provide “Aadhaar services” to common people for a charge, including the printing of Aadhaar cards.

247,000 DHS current and former federal employees affected by a privacy incident

4.1.2017 securityaffairs Incindent

A privacy incident suffered by the Department of Homeland Security (DHS) exposed data related to 247,167 current and former federal employees.

A data breach suffered by the Department of Homeland Security exposed data related to 247,167 current and former federal employees that were employed by the Agency in 2014.

The data breach affected a database used by the DHS Office of the Inspector General (OIG) that was stored in the Department of Homeland Security OIG Case Management System.

“On January 3, 2018, select DHS employees received notification letters that they may have been impacted by a privacy incident related to the DHS Office of Inspector General (OIG) Case Management System. The privacy incident did not stem from a cyber-attack by external actors, and the evidence indicates that affected individual’s personal information was not the primary target of the unauthorized transfer of data.” reads the announcement published by the DHS.

Exposed data includes employee names, Social Security numbers, birth dates, positions, grades, and duty stations.

The incident also affected a second group of individuals (i.e., subjects, witnesses, and complainants) associated with Department of Homeland Security OIG investigations from 2002 through 2014 (the “Investigative Data”).

The data leak was the result of an unauthorized copy of the DHS OIG investigative case management system that was in the possession of a former DHS OIG employee.

The copy was discovered as part of an ongoing criminal investigation being conducted by Department of Homeland Security OIG and the U.S. Attorney’s Office

The data breach was discovered on May 10, 2017, as part of an ongoing criminal investigation conducted by OIG and the U.S. Attorney’s Office.

The Department of Homeland Security sent notification letters to affected individuals, it is also implementing additional security measured to limit access to such kind of information.

All individuals potentially affected by the incident are being offered 18 months of free credit monitoring and identity protection services.

“Department of Homeland Security is implementing additional security precautions to limit which individuals have access to this information and will better identify unusual access patterns. ” continues the Department of Homeland Security.

“We will continue to review our systems and practices in order to better secure data. DHS OIG has also implemented a number of security precautions to further secure the DHS OIG network,”

247,000 DHS Employees Affected by Data Breach

4.1.2018 securityweek Incindent

Information on nearly a quarter million Department of Homeland Security (DHS) employees was exposed as part of an "unauthorized transfer of data", the DHS announced.

The privacy incident involved a database used by the DHS Office of the Inspector General (OIG) which was stored in the DHS OIG Case Management System.

The incident impacted approximately 247,167 current and former federal employees that were employed by DHS in 2014. The exposed Personally identifiable information (PII) of these individuals includes names, Social Security numbers, birth dates, positions, grades, and duty stations.

Individuals (both DHS employees and non-DHS employees) associated with DHS OIG investigations from 2002 through 2014 (including subjects, witnesses, and complainants) were also affected by the incident, the DHS said.

The PII associated with these individuals varies depending on the documentation and evidence collected for a given case and could include names, social security numbers, alien registration numbers, dates of birth, email addresses, phone numbers, addresses, and personal information provided in interviews with DHS OIG investigative agents.

The data breach wasn’t the result of an external attack, the DHS claims. The leaked data was found in an unauthorized copy of the DHS OIG investigative case management system that was in the possession of a former DHS OIG employee.

The data breach was discovered on May 10, 2017, as part of an ongoing criminal investigation conducted by DHS OIG and the U.S. Attorney’s Office.

“The privacy incident did not stem from a cyber-attack by external actors, and the evidence indicates that affected individual’s personal information was not the primary target of the unauthorized exfiltration,” DHS explained.

The Department said that notification letters were sent to select DHS employees to inform them that they might have been impacted. DHS also says that it conducted a thorough privacy investigation, a forensic analysis of the compromised data, and assessed the risk to affected individuals before making the incident public.

Following the incident, the DHS says it is implementing additional security precautions to limit access to the type of information that was released in this incident and to better identify unusual access patterns.

“We will continue to review our systems and practices in order to better secure data. DHS OIG has also implemented a number of security precautions to further secure the DHS OIG network,” DHS notes.

Additional information for the affected individuals is available in an announcement and FAQ published on Jan 3.

Forever 21 confirms Payment Card Breach and provides further info on the incident

1.1.2018 securityaffairs Incindent

FOREVER 21 confirmed the presence of a malware at some point of sale (POS) systems in stores across the US.

On November 2017, the US clothes retailer FOREVER 21 announced it has suffered a security breach, the company now confirmed that hackers stole payment card data from its locations throughout the country for several months during 2017.

Even if the investigation is still ongoing, FOREVER 21 confirmed the presence of a malware at some point of sale (POS) systems in stores across the US, the malicious code was used at least between April 3, 2017, and November 18, 2017.

The payment made on the company website, forever21.com, were not affected by the incident.

The company explained that it has been using encryption technology since 2015 to protect its payment processes, but the investigation revealed that the encryption was switched off for some POS terminals at certain stores, a circumstance that allowed crooks to install the malware.

“The investigation determined that the encryption technology on some point-of-sale (POS) devices at some stores was not always on. The investigation also found signs of unauthorized network access and installation of malware on some POS devices designed to search for payment card data. The malware searched only for track data read from a payment card as it was being routed through the POS device. In most instances, the malware only found track data that did not have cardholder name – only card number, expiration date, and internal verification code – but occasionally the cardholder name was found.” reads the advisory published by the company.

“The investigation found that encryption was off and malware was installed on some devices in some U.S. stores at varying times during the period from April 3, 2017 to November 18, 2017. In some stores, this scenario occurred for only a few days or several weeks, and in some stores this scenario occurred for most or all of the timeframe.”

FOREVER 21

The company pointed out that not every POS terminal in affected stores was infected with the malware

“Each Forever 21 store has multiple POS devices, and in most instances, only one or a few of the POS devices were involved. Additionally, Forever 21 stores have a device that keeps a log of completed payment card transaction authorizations,” the company said while explaining the incident.

“When encryption was off, payment card data was being stored in this log. In a group of stores that were involved in this incident, malware was installed on the log devices that was capable of finding payment card data from the logs, so if encryption was off on a POS device prior to April 3, 2017, and that data was still present in the log file at one of these stores, the malware could have found that data.”

The company advised customers who shopped at its locations to monitor their credit transactions for any suspicious activity.

Ancestry.com Responds Well To RootsWeb Data Breach

30.12.2017 securityaffairs Incindent

The popular expert Troy Hunt notified the Ancestry.com security team of an unsecured file on a RootsWeb server containing “email addresses/username and password combinations as well as usernames from a RootsWeb.com server”.

When you think of personal security questions, you might think of your mother’s surname or other family information that normally isn’t shared — unless you are building your family tree with an online genealogy search. When Ancestry.com notifies its users of a potential security breach it sounds worse than most.

Ancestry.com is a company with millions of customers that use their online tools to research their family tree. The company also hosts servers for RootsWeb, a free, community-driven collection of genealogy tools and discussion forums. On December 20th, 2017, Troy Hunt, of HaveIBeenPwned.com, notified the Ancestry.com security team of an unsecured file on a RootsWeb server containing “email addresses/username and password combinations as well as usernames from a RootsWeb.com server”, and a quick and detailed investigation ensued.

According to Ancestry.com’s blog post detailing the incident, the security team reviewed the file identified by Hunt, and determined that it does contain login details for 300,000 accounts although they describe, “the majority of the information was old.” They continued their investigation and determined that of the 300,000 accounts, 55,000 had been reused by users on both the RootsWeb and Ancestry websites. Most of the 55,000 were “from free trial, or currently unused accounts,” but 7,000 login credentials were in use by active Ancestry.com users. Ancestry.com supports millions of users so this breach represents less than 1% of their users, however, they still took the potential impacts seriously and acted accordingly.

The internal investigation points to the RootsWeb surname list information service which Ancestry.com retired earlier this year. “We believe the intrusion was limited to the RootsWeb surname list, where someone was able to create the file of older RootsWeb usernames and passwords as a direct result of how part of this open community was set up, an issue we are working to rectify”, according to the blog post by Ancestry.com CISO, Tony Blackman.

He continued with, “We have no reason to believe that any Ancestry systems were compromised. Further, we have not seen any activity indicating the compromise of any individual Ancestry accounts.” According to Ancestry, the RootsWeb servers do not host any credit card or social insurance numbers so the potential impact of this breach appears to be minimized.

The RootsWeb website is currently offline while the Ancestry teams complete their investigation, make the appropriate configuration changes and “ensure all data is saved and preserved to the best of [their] ability.”

In addition, the Ancestry has locked the 55,000 accounts found in the exposed file, requiring users to change their passwords the next time they attempt to log on. They sent emails to all 55,000 email addresses advising them of the incident and recommended actions, and commit to “working with regulators and law enforcement where appropriate.”

To summarize, the Ancestry.com security team responded quickly when notified of a potential breach, determined the potential scope and impact, took swift action to minimize damages, notified impacted users, clearly and publicly described the event. Troy Hunt’s tweet describes it best, “Another data breach from years ago, this time from @Ancestry’s services. Really impressed with the way they handled this: I got in touch with them bang on 72 hours ago and they’ve handled it in an exemplary fashion.”

Troy Hunt

✔

@troyhunt

Another data breach from years ago, this time from one of @Ancestry's services. Really impressed with the way they handled this: I got in touch with them bang on 72 hours ago and they've handled it in an exemplary fashion https://blogs.ancestry.com/ancestry/2017/12/23/rootsweb-security-update/ …

Nissan Finance Canada Suffers Data Breach — Notifies 1.13 Million Customers

22.12.2017 thehackernews Incindent

It's the last month of this year, but possibly not the last data breach report.

Nissan warns of a possible data breach of personal information on its customers who financed their vehicles through Nissan Canada Finance and INFINITI Financial Services Canada.

Although the company says it does not know precisely how many customers were affected by the data breach, Nissan is contacting all of its roughly 1.13 million current and previous customers.

In a statement released Thursday, Nissan Canada said the company became aware of an "unauthorized access to personal information" of some customers on December 11.

"Nissan Canada Finance recently became aware it was the victim of a data breach that may have involved an unauthorized person(s) gaining access to the personal information of some customers that have financed their vehicles through Nissan Canada Finance and INFINITI Financial Services Canada," the company said.

It's believed that the unknown hacker(s) may have had access to the following information:

Customers' names

Home addresses

Vehicle makes and models

Vehicle identification numbers (VIN)

Credit scores

Loan amounts

Monthly payments

The company says there no indication, at least at this moment, that if the data breach also includes payment information and contactable information like email addresses or phone numbers.

The company offers 12 months of free credit monitoring services through TransUnion to all of its financed customers.

Since the investigation into the data breach incident is still ongoing, it is not clear if the hack also impacts customers outside of Canada and customers who did not obtain financing through NCF.

"We sincerely apologize to the customers whose personal information may have been illegally accessed and for any frustration or inconvenience that this may cause," Nissan Canada president Alain Ballu said. "We are focused on supporting our customers and ensuring the security of our systems."

Nissan Canada has contacted Canadian privacy regulators, law enforcement, and data security experts to help rapidly investigate the matter.

Nissan Canada Informs 1.1 Million Customers of Data Breach

22.12.2017 securityweek Incindent

Nissan Canada revealed on Thursday that the personal information of some customers may have been compromised as a result of a data breach discovered by the company on December 11.

The incident affects individuals who have financed their vehicles through Nissan Canada Finance (NCF) and INFINITI Financial Services Canada. The exact number of impacted customers has yet to be determined, but Nissan is notifying all 1.13 million current and past customers.

While the company believes not all customers are affected, it has decided to offer all of them free credit monitoring services through TransUnion for a period of 12 months. NCF is in the process of sending out emails and letters to individuals whose information may have been compromised.

The attacker could have stolen names, addresses, vehicle details, vehicle identification numbers (VINs), credit scores, loan amounts, and information on monthly payments. Nissan Canada says the incident does not appear to involve payment card information.

There is no indication that Nissan or Infiniti customers in Canada who did not obtain financing through NCF or customers outside of Canada are impacted.

The company is working with law enforcement and data security experts to investigate the incident and has not made any comments on who might be behind the attack. Canadian privacy regulators have also been informed of the breach.

This is not the first time Nissan has been targeted by hackers. Back in 2012, the company reported finding malware on its global information systems network. Last year, the company was forced to shut down its global websites due to a cyberattack apparently motivated by anger over Japan's controversial whale and dolphin hunts.

Nissan Finance Canada hacked, 1.13 million customers may have been exposed

22.12.2017 securityaffairs Incindent

Nissan Finance Canada announced on Thursday that the personal information of 1.13 million customers may have been exposed as a result of a data breach.

Nissan Finance Canada has been hacked, personal information of 1.13 million customers may have been exposed as a result of a data breach discovered by the company on December 11 (The biz took 10 days to disclose the incident).

The company notified customers via email the incident, it confirmed that its systems were compromised, with “unauthorized person(s) gaining access to the personal information of some customers that have financed their vehicles through Nissan Canada Finance or Infiniti Financial Services Canada.”

“We apologize for any frustration and anxiety this may cause our customers, and we thank you for your patience and support as we work through this issue.”

Nissan published a quite similar message on its website too, it added that at this time, there is no indication that customers who financed vehicles outside of Canada are affected. According to Nissan Canada, compromised data includes customer names, addresses, vehicle makes and models, vehicle identification numbers (VINs), credit scores, loan amounts and monthly payment figures.

Financial information belonging to the customers, such as payment card data was not affected.

“Nissan Canada Finance (NCF) is notifying its customers in Canada that it is a victim of a data breach that may have involved unauthorized person(s) gaining access to the personal information of some customers that have financed their vehicles through Nissan Canada Finance and INFINITI Financial Services Canada.” states the message published on the company website.

“On December 11, 2017, NCF became aware of unauthorized access to personal information.” “While the precise number of customers affected by the data breach is not yet known, NCF is contacting all of our current and past customers – approximately 1.13 million customers – who have financed their vehicles through Nissan Canada Finance and INFINITI Financial Services Canada.”

The company is investigating the attack with the help of law enforcement trying to figure out the extension of the incident and potential impact on its customers.

“We are still investigating precisely what personal information has been impacted,” the company added.

Nissan is offering 12 months of credit monitoring services through TransUnion at no cost.

California Voter Data Stolen from Insecure MongoDB Database

18.12.2017 securityweek Incindent

An improperly secured MongoDB database has provided cybercriminals with the possibility to steal information on the entire voting population of California, Kromtech security researchers reported.

The information was taken from an unprotected instance of a MongoDB database that was exposed to the Internet, meaning that anyone connected to the web could have accessed, viewed, or edited the database’s content.

Named 'cool_db', the database contained two collections, one being a manually crafted set of voter registration data for a local district, while the other apparently including data on the voting population from the entire state of California: a total of 19,264,123 records.

Bob Diachenko, head of communications, Kromtech Security Center, explains that the security firm was “unable to identify the owner of the database or conduct a detailed analysis.” It appears that the database has been erased by cybercriminals who dropped a ransom note demanding 0.2 Bitcoin for the data.

Given the presence of said ransom note, the incident is believed to be related to the MongoDB ransack campaign that resulted in tens of thousands of databases being erased in January 2017. Similar attacks were observed in September as well, when MongoDB decided to implement new data security measures.

“We were able to analyze the stats data we saw in our report (metadata on total number of records, uptime, names of the collection etc.), as well as 20-records sample extracted from the database shortly before it has been wiped out and ransom note appeared,” Diachenko says.

Kromtech's security researchers haven’t determined who compiled the voter database but believe that a political action committee might have been behind it, given the unofficial name the repository had.

The miscreants behind the attack used ransomware to wipe out the voter data, but are believed to have copied the database to their server first. “Once in the hands of cyber criminals this voter data could end up for sale on the Dark Web. If this were an official database, deleting parts of that data could affect someone’s voting process,” the security researchers note.

The first, smaller collection (4GB) contained data structured with rows containing many fields that included home address, phone number, date of birth, and many more.

Based on EstractDate information, the database appears to have been created on May 31, 2017.

The second, much larger collection (22GB) in the database, which appears to be the complete California voter registration records, contains a total of 409,449,416 records.

The data in the larger collection includes: District, RegistrantId, CountyCode, DistrictName and ObjectId.

“This is a massive amount of data and a wakeup call for millions citizens of California who have done nothing more than fulfil the civic duty to vote. This discovery highlights how a simple human error of failing to enact the basic security measures can result in a serious risk to stored data. The MongoDB was left publically available and was later discovered by cyber criminals who seemed to steal the data, which origin is still unknown,” Diachenko concludes.

The researchers note that the database has been taken down after being initially discovered in early December. The Secretary of State of California was aware of the leak and “looking into it,” Diachenko said.

Collection of 1.4 Billion Plain-Text Leaked Passwords Found Circulating Online

12.12.2017 thehackernews Incindent

Hackers always first go for the weakest link to quickly gain access to your online accounts.

Online users habit of reusing the same password across multiple services gives hackers opportunity to use the credentials gathered from a data breach to break into their other online accounts.

Researchers from security firm 4iQ have now discovered a new collective database on the dark web (released on Torrent as well) that contains a whopping 1.4 billion usernames and passwords in clear text.

The aggregate database, found on 5 December in an underground community forum, has been said to be the largest ever aggregation of various leaks found in the dark web to date, 4iQ founder and chief technology officer Julio Casal noted in a blog post.

Though links to download the collection were already circulating online over dark-web sites from last few weeks, it took more exposure when someone posted it on Reddit a few days ago, from where we also downloaded a copy and can now verify its authenticity.

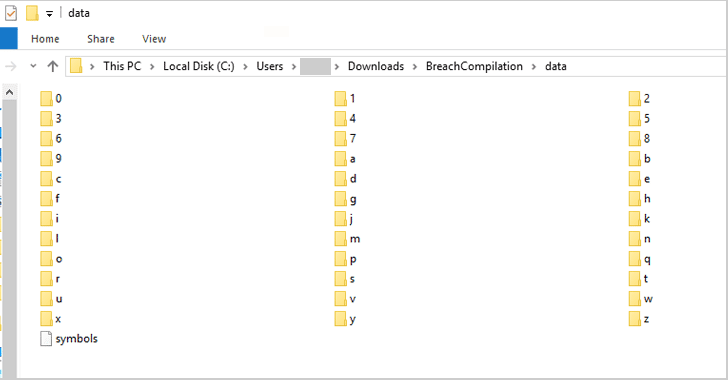

Researchers said the 41GB massive archive, as shown below, contains 1.4 billion usernames, email, and password combinations—properly fragmented and sorted into two and three level directories.

The archive had been last updated at the end of November and didn't come from a new breach—but from a collection of 252 previous data breaches and credential lists.

The collective database contains plain text credentials leaked from Bitcoin, Pastebin, LinkedIn, MySpace, Netflix, YouPorn, Last.FM, Zoosk, Badoo, RedBox, games like Minecraft and Runescape, and credential lists like Anti Public, Exploit.in.

"None of the passwords are encrypted, and what's scary is that we've tested a subset of these passwords and most of the have been verified to be true," Casal said. "The breach is almost two times larger than the previous largest credential exposure, the Exploit.in combo list that exposed 797 million records."

"This new breach adds 385 million new credential pairs, 318 million unique users, and 147 million passwords pertaining to those previous dumps."

The database has been neatly organized and indexed alphabetically, too, so that would-be hackers with basic knowledge can quickly search for passwords.

For example, a simple search for "admin," "administrator" and "root," returned 226,631 passwords used by administrators in a few seconds.

Although some of the breach incidents are quite old with stolen credentials circulating online for some time, the success ratio is still high for criminals, due to users lousy habit of re-using their passwords across different platforms and choosing easy-to-use passwords.

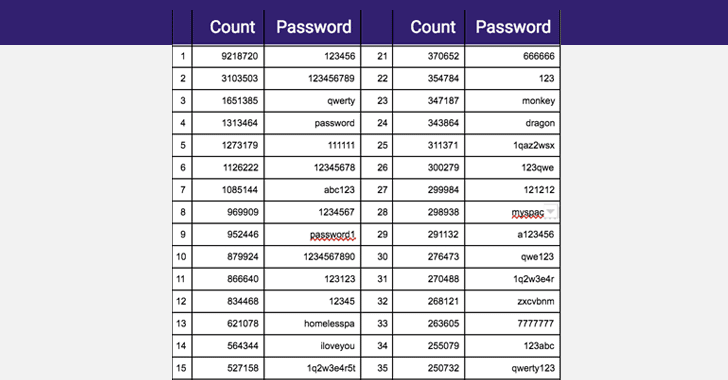

The most common yet worst passwords found in the database are "123456", "123456789", "qwerty," "password" and "111111."

It is still unclear who is responsible for uploading the database on the dark web, but whoever it is has included Bitcoin and Dogecoin wallets for any user who wants to donate.

To protect yourself, you are strongly advised to stop reusing passwords across multiple sites and always keep strong and complex passwords for your various online accounts.

If it's difficult for you to remember and create complex passwords for different services, you can make use of the best password manager. We have listed some good password managers that could help you understand the importance of such tool and choose one according to your requirement.

Cybersecurity Incidents Hit 83% of U.S. Physicians: Survey

12.12.2017 securityweek Incindent

A majority of physicians in the United States have experienced a cybersecurity incident, and many are very concerned about the potential impact of a cyberattack, according to a study conducted by professional services company Accenture and the American Medical Association (AMA).

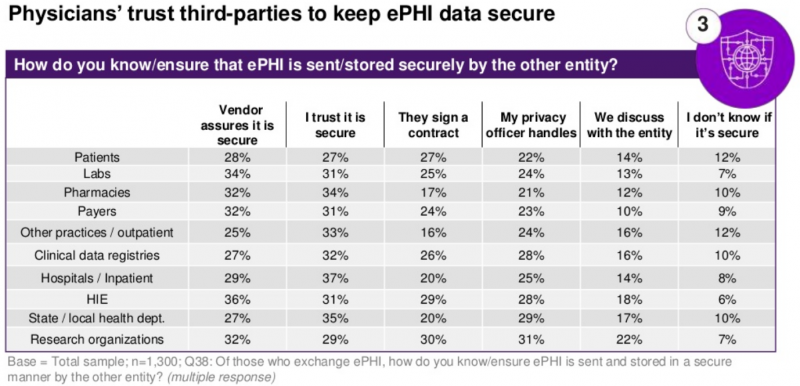

A survey of 1,300 doctors revealed that 83% of clinical practices experienced some type of cybersecurity incident. The most common is phishing (55%), followed by malware infections (48%), improper access to electronic protected health information, or ePHI (37%), network breaches (12%), and ransomware and other attacks involving ransom demands (9%).

More than half of respondents said they were either very concerned or extremely concerned about future cyberattacks, particularly that they may result in interruption to their business or electronic health records (EHR) getting compromised. Physicians are also worried about patient safety (53%), civil or criminal liability (36%), damage to reputation (34%), costs associated with incident response (32%), impact on revenue (30%), fines (25%), and medical device security (19%).

When asked about the impact of past cybersecurity incidents on their business, 64% of respondents said it had caused downtime of four hours or less, but in 12% of cases normal operations were suspended for 1-2 days, and in 4% of cases for more than two days.

In response to incidents, the most common actions were notification of the internal IT team (65%), notification or education of employees (61%), implementation of new policies and procedures (59%), and notification of the EHR or health IT vendor (56%).

While doctors are concerned about the security risks associated with the use of electronic systems, they also noted that the ability to share data with outside entities is in most cases very important.

The study also shows that physicians often trust third parties to keep their ePHI data secure. In many cases, they either get assurance from the vendor or simply trust that their data is being protected. Many also sign contracts or rely on their privacy officer to ensure that sensitive information is stored securely.

Nearly half of organizations have an in-house person responsible for cybersecurity and 17% said they are interested in appointing someone to such a position. Others either outsource security management (26%), or share security management with another practice (23%). Some physicians said they received donated cybersecurity software or hardware.

When it comes to security training, half of respondents named tips for good cyber hygiene as the factor that would boost their confidence in their security posture. Others named simplifying the legal language of HIPAA (47%), easily digestible summary of HIPAA (44%), explaining the more complex rules described by HIPAA (40%), and guidance on conducting risk assessments (38%).

A collection of 1.4 Billion Plain-Text leaked credentials is available online

12.12.2017 securityaffairs Incindent

A 41-gigabyte archive containing 1.4 Billion credentials in clear text was found in dark web, it had been updated at the end of November.

Another monster data dump was found online, the huge archive contains over 1.4 billion email addresses, passwords, and other credentials in clear text.

The huge trove of data, a 41-gigabyte archive, has been found online on December 5 by security shop @4iQ.

According to 4iQ founder and chief technology officer Julio Casal, the archive is the largest ever aggregation of various leaks found in the dark web to date.

“While scanning the deep and dark web for stolen, leaked or lost data, 4iQdiscovered a single file with a database of 1.4 billion clear text credentials — the largest aggregate database found in the dark web to date.” reads a post published by 4iQ on Medium.

“None of the passwords are encrypted, and what’s scary is the we’ve tested a subset of these passwords and most of the have been verified to be true.”

The 41-gigabyte file had been updated at the end of November, it aggregates data from a collection of 252 previous data breaches and credential lists.

It is still unclear who collected this data, the unique information we have at this time is the Bitcoin and Dogecoin wallet details left for donations.

Collector organized and indexed data alphabetically, the total amount of credentials is 1,400,553,869.

“The breach is almost two times larger than the previous largest credential exposure, the Exploit.in combo list that exposed 797 million records.” continues Julio Casal.

“This new breach adds 385 million new credential pairs, 318 million unique users, and 147 million passwords pertaining to those previous dumps.”

Digging the archive, it is possible to verify that users continue to use weak passwords, the top password is still 123456, followed by 123456789, qwerty, password and 111111.

Not only … the expert observed that users tend to reuse the same passwords for multiple online services.

“Since the data is alphabetically organized, the massive problem of password reuse — — same or very similar passwords for different accounts — — appears constantly and is easily detectable.” states the post.

The researchers highlighted that 14% of exposed credentials are new and in clear text.

“We compared the data with the combination of two larger clear text exposures, aggregating the data from Exploit.in and Anti Public. This new breach adds 385 million new credential pairs, 318 million unique users, and 147 million passwords pertaining to those previous dumps.” continues the expert.

As usual, let me suggest avoiding password reuse on multiple sites and of course use strong passwords.

Database of 1.4 Billion Credentials Found on Dark Web

11.12.2017 securityweek Incindent

Researchers have found a database of 1.4 billion clear text credentials in what appears to be the single largest aggregate database yet found on the dark web. These are not from a new breach, but a compilation of 252 previous breaches, including the previous largest combo list, Exploit.in.

The database was found by 4iQ on 5 December 2017. Announcing the discovery, the firm's founder and CTO Julio Casal, said, "This is not just a list. It is an aggregated, interactive database that allows for fast (one second response) searches and new breach imports... The database was recently updated with the last set of data inserted on 11/29/2017. The total amount of credentials (usernames/clear text password pairs) is 1,400,553,869."

It is a database designed to be used. It includes search tools and insert scripts explained in a README file. Another file called 'imported.log' lists the breach sources; for example '/inputbreach/linkedin110M_1 865M'. There are four such LinkedIn input files, in a total of 256 inputs.

The data is structured in an alphabetic directory tree fragmented in 1,981 pieces to allow fast searches. In a test, 4iQ notes, "searching for 'admin,' 'administrator' and 'root' returned 226,631 passwords of admin users in a few seconds." The combination of database structure and clear text credentials makes it an easy tool for bad actors to use for bad purposes. "Now even unsophisticated and newbie hackers can access the largest trove ever of sensitive credentials in an underground community forum," comments Casal. "Is the cyber crime epidemic about become exponentially worse?"

The raw data has probably been available to criminals on the dark web from soon after many of the breaches -- but this new database takes out much of the labor needed to use the stolen credentials.

"Large databases of passwords containing both hashed and clear text have been available for years, that are easy to download to use with password cracking software," Joe Carson, chief security scientist at password protection firm Thycotic, told SecurityWeek. "These password databases are available to both skilled hackers and script kiddies with basic knowledge that can be easily used with software that is easily downloadable from the internet. Today all you need is a computer and an internet connection to be a hacker."

But use of these databases still required effort. "In the past hackers would have accessed each breached database containing passwords, and correlated them on their own," he added; "but why do that when someone will do it for you and make it easy downloadable?"

Freelance security consultant and researcher Robin Wood (aka DigiNinja, author of the widely used Pipal password analyzer), explains how the database could be used by bad actors. "The most obvious," he says, "is to take large chunks of the files and spray them against popular sites to see which still work." This is basic 'credential stuffing'.

Carson notes that "previous research has found that at least 25 percent of leaked google passwords are still active and still work, which means that many people still fail to change their passwords even after a major data breach has occurred." The implication is that credential stuffing from this new database could prove very effective for the hackers.

Wood adds, "[The announcement] doesn't say whether the [discovery] lists which individual dump the creds came from, although it does say which sources were used to create the list; so that is a good list of targets to start with."

However, he also warns that the searchable nature of this database gives additional concerns. "It can also be used for more targeted attacks. Pick your target company and search for references to it in the list to find staff, contractors or suppliers. This could give both an initial foothold into the company, or -- if someone is already in -- to help move around if credentials have been reused internally."

What isn't clear is where this database has come from, nor why it has suddenly appeared on the dark web. Clearly, considerable time and effort has gone into its design and creation to make it large scale and easy to use; but it doesn't appear to have a direct monetization methodology for now. "There is not [sic] indication of the author of the database and tools," writes Casal, "although Bitcoin and Dogecoin wallets are included for donation." Of course, the author could be intending to 'charge' for future maintenance of the database with new additions as they become available.

"My first thought," comments Wood, "was whether this is the database that was behind the recently shut down LeakedBase site." LeakedBase was an online service that provided paid access to leaked credentials. It was shut down just days before 4iQ made its discovery. "Their database," continued Wood, "gave out clear text passwords, so it could be the same. Maybe the owners decided it was too risky running a site giving access to the creds but wanted to drop it out there and try to make some money off donations instead."

Whatever the reasons behind this database, its availability on the dark web provides an additional threat to users who don't change their passwords. "It is clear that people do not even change passwords after a major data breach," says Carson. "It is also poor hygiene that the companies impacted by these data breaches still do not force a password reset leaving many of their customers' accounts exposed and vulnerable to abuse by cybercriminals."

NiceHash: security breach leads to 60 million lost – Iceman is behind?

8.12.2017 securityaffairs Incindent

NiceHash has been hacked, roughly to 60$ million (4,736.42 BTC) have been stolen while the bitcoin is crossing the 14k$ mark for the first time.

A dark day for cryptocurrency miners, NiceHash has been hacked. Closely to 60$ millions (4,736.42 BTC) have been stolen while the bitcoin is crossing the 14k$ mark for the first time.

The hacker’s bitcoin address cleary shows the steal of 4,736.42 BTC in a window of 48 hours:https://bitinfocharts.com/bitcoin/address/1EnJHhq8Jq8vDuZA5ahVh6H4t6jh1mB4rq

NiceHash users are furious by the time of reaction of the team. It took about 24 hours to realize that big amounts have been stolen.

I’ve contacted a member of Iceman and knowing this security breach for some reason he explained that NiceHash actually owned their users’ bitcoin wallets in order to save transactions fees and collect unclaimed BTC. This issue leads to a massive security breach which allows access to all NiceHash wallets. He claimed that by reverse engineering of their miner client, Iceman group was able to access their API.

Is Iceman really behind this attack?

About the Author: Marc Miller

Marc Miller is a web journalist, focused on cybercrime.

He started a blog called: THE PURPLE HAT – Cyber Gangs NAKED, dedicated to exposing the methods and works of cybercrime gangs such as “CARBANAK” or similar sophisticated syndicated Cybercrime organizations.

In the past. he worked as a web front-end programmer. Also, he is passionate about hardware, hacking, security and marketing.

NiceHash Hacked – Crooks have allegedly stolen $60m worth of Bitcoin

7.12.2017 securityweek Incindent

The cryptocurrency mining market NiceHash confirmed it has fallen victim to a hacking attack that may have resulted in the loss of $60m worth of Bitcoin

Cryptocurrency companies continue to be a privileged target of hackers, the last victim in order of time is the cryptocurrency mining market NiceHash. The NiceHash marketplace allows users to buy and sell their computing cycles to mine cryptocurrency, the company confirmed it was hacked, attackers stole its entire Bitcoin wallet.

“Unfortunately, there has been a security breach involving NiceHash website. We are currently investigating the nature of the incident and, as a result, we are stopping all operations for the next 24 hours.” reads the statement issued by NiceHash.

“Importantly, our payment system was compromised and the contents of the NiceHash Bitcoin wallet have been stolen. We are working to verify the precise number of BTC taken.”

The security breach has been reported to law enforcement, the company is also investigating the attack.

Even if NiceHash did not provide financial data on the security breach, it has been estimated hackers have stolen around $60m.

NiceHash declared that it is fully committed to restoring the service with the highest security measures, it doesn’t want to exit from the market due to the incident.

The company doesn’t provide further details on the hack, as a precaution it recommends users to change their online passwords.

“While the full scope of what happened is not yet known, we recommend, as a precaution, that you change your online passwords.” concludes the statement.“We are truly sorry for any inconvenience that this may have caused and are committing every resource towards solving this issue as soon as possible.”

The security breach was disclosed just hours after NiceHash confirmed its website was down for maintenance.

NiceHash

@NiceHashMining

Dear NiceHash user, our service is currently under maintenance.

We are sorry for the inconvenience and please stay tuned for updates.

Thank you for your understanding.

8:52 AM - Dec 6, 2017

201 201 Replies 64 64 Retweets 179 179 likes

Twitter Ads info and privacy

At the time of writing, The NiceHash website still shows a maintenance page.

PayPal Subsidiary Data Breach Hits Up to 1.6 Million Customers

5.12.2017 thehackernews Incindent

Global e-commerce business PayPal has disclosed a data breach that may have compromised personally identifiable information for roughly 1.6 million customers at a payment processing company PayPal acquired earlier this year.

PayPal Holdings Inc. said Friday that a review of its recently acquired company TIO Networks showed evidence of unauthorized access to the company's network, including some confidential parts where the personal information of TIO's customers and customers of TIO billers stored.

Acquired by PayPal for US$233 Million in July 2017, TIO Network is a cloud-based multi-channel bill payment processor and receivables management provider that serves the largest telecom, wireless, cable and utility bill issuers in North America.

PayPal did not clear when or how the data breach incident took place, neither it revealed details about the types of information being stolen by the hackers, but the company did confirm that its platform and systems were not affected by the incident.

"The PayPal platform is not impacted in any way, as the TIO systems are completely separate from the PayPal network, and PayPal's customers' data remains secure," The data breach in TIO Networks was discovered as part of an ongoing investigation for identifying security vulnerabilities in the payment processing platform.

As soon as PayPal identified an unauthorized access to the TIO's network, PayPal took action by "initiating an internal investigation of TIO and bringing in additional third-party cybersecurity expertise to review TIO's bill payment platform," PayPal press release [PDF] reads.

The company has begun working with companies it services to notify potentially affected customers.

Besides notifying, the company is also working with a consumer credit reporting agency, Experian, to provide free credit monitoring memberships for fraud and identity theft to those who are affected by the breach.

To protect its customers, TIO has also suspended its services until a full-scale investigation into the incident is completed.

"At this point, TIO cannot provide a timeline for restoring bill pay services, and continues to recommend that you contact your biller to identify alternative ways to pay your bills," TIO's Consumer FAQ reads.

"We sincerely apologize for any inconvenience caused to you by the disruption of TIO's service."

Since the investigation is ongoing, PayPal will communicate with TIO customers and merchant partners directly as soon as the company has more details on the incident. Also, the affected customers will be directly contacted by the company.

PayPal-owned company TIO Networks data breach affects 1.6 million customers

4.12.2017 securityaffairs Incindent

PayPal confirmed that one of the companies it owns, TIO Networks, suffered a security breach, that affected 1.6 million customers.

PayPal confirmed that one of the companies it owns, TIO Networks, suffered a security breach, hackers have accessed servers that stored information for 1.6 million customers.

The company TIO Networks was recently acquired by PayPal for $238 million, it is a Canadian firm that runs a network of over 60,000 utility and bills payment kiosks across North America.

On November 10, PayPal suspended the operations of TIO’s network due to the discovery of “security vulnerabilities” affecting the TIO platform and issues with TIO’s data security programme that does not follow PayPal’s security standards.

“While we apologise for any inconvenience this suspension of services may cause, the security of TIO’s systems and the protection of TIO’s customers are our highest priorities.” said TIO Networks.

“We are working with the appropriate authorities to safeguard TIO customers.”

“The PayPal platform is not impacted by this situation in any way and PayPal’s customers’ data remains secure.

“Our investigation is ongoing. We will communicate with TIO customers and merchant partners directly as soon as we have more details. Customer updates will also be posted at www.tio.com.”

The Canadian firm disclosed the data breach, but did not provide any other details.

On Friday, December 1, PayPal published a press release that includes more details on the hack.

“PayPal Holdings, Inc. (Nasdaq: PYPL) today announced an update on the suspension of operations of TIO Networks (TIO), a publicly traded payment processor PayPal acquired in July 2017. A review of TIO’s network has identified a potential compromise of personally identifiable information for approximately 1.6 million customers.” reads the press release.

“The PayPal platform is not impacted in any way, as the TIO systems are completely separate from the PayPal network, and PayPal’s customers’ data remains secure.”

TIO systems are completely separate from the PayPal network, this means that PayPal’s customers’ data were not affected by the incident.

PayPal confirmed that the attackers stole the personal information of both TIO customers and customers of TIO billers, but it avoided to disclose what type of information the hackers compromised.

Likely attackers accessed personally-identifiable information (PII) and financial details.

PayPal is notifying affected customers of the data breach and is offering free credit monitoring memberships.

The customers of TIO Networks can visit the TIO Networks website for more information on the data breach.

“TIO has also begun working with the companies it services to notify potentially affected individuals, and PayPal is working with a consumer credit reporting agency to provide free credit monitoring memberships. Individuals who are affected will be contacted directly and receive instructions to sign up for monitoring.” continue the Press Release.

Breach at PayPal Subsidiary Affects 1.6 Million Customers

4.12.2017 securityweek Incindent

PayPal informed customers on Friday that personal information for 1.6 million individuals may have been obtained by hackers who breached the systems of its subsidiary TIO Networks.

TIO is a publicly traded bill payment processor that PayPal acquired in July 2017 for roughly $230 million. The company is based in Canada and it serves some of the largest telecom and utility network operators in North America. TIO has more than 10,000 supported billers and it serves 16 million consumer bill pay accounts.

On November 10, PayPal announced that TIO had suspended operations in an effort to protect customers following the discovery of security vulnerabilities on the subsidiary's platform. PayPal said it had found issues with TIO’s data security program that did not adhere to its own standards.

An investigation conducted in collaboration with third-party cybersecurity experts revealed that TIO’s network had been breached, including servers that stored the information of TIO clients and customers of TIO billers. PayPal said the attackers may have obtained personally identifiable information (PII) for roughly 1.6 million customers.

Affected companies and individuals will be contacted via mail and email, and offered free credit monitoring services via Experian.

While it’s unclear exactly what type of data the hackers have gained access to, the information shared by PayPal and TIO suggests that payment card data and in some cases even social security numbers (SSNs) may have been compromised.

PayPal has highlighted that TIO’s systems have not been integrated into its own platform. “The PayPal platform is not impacted in any way, as the TIO systems are completely separate from the PayPal network, and PayPal’s customers’ data remains secure,” the company said.

The New York State Department of Financial Services (DFS), an agency responsible for regulating financial services and products, has also issued a statement on the incident.

“DFS is working with our regulated entity, PayPal, to investigate and address issues related to cybersecurity vulnerabilities identified at PayPal’s subsidiary, TIO Networks,” the DFS said. “We applaud PayPal’s rapid response to the matter, which put consumers and business clients first, and we appreciate their efforts to inform DFS, as required, in a timely manner. Events like these illustrate the necessity of DFS’s landmark cybersecurity regulation and underscore the strength and effectiveness of our strong state-based financial services regulatory framework, including for the fintech industry.”

TIO said services will not be fully restored until it’s confident that its systems and network are secure.

The Shipping Giant Clarkson has suffered a security breach

30.11.2017 securityaffairs Incindent

Clarkson, one of the world’s largest providers of shipping services publicly disclosed a security breach.

Clarkson confirmed the hackers may release some of the stolen data, it hasn’t provided further details due to the ongoing law enforcement investigation.

The information disclosed by the company suggests cyber criminals blackmailed the company requesting the payment of a ransom in order to avoid having its data leaked online.

According to Clarkson, the hackers compromised a single user account to access the systems of the shipping giant.

“Clarkson PLC confirms that it was subject to a cybersecurity incident which involved unauthorised access to the Company’s computer systems.” Clarkson said in a statement.

“Our initial investigations have shown the unauthorised access was gained via a single and isolated user account which has now been disabled.”

The company has disabled the account after the incident and has started notifying affected customers and individuals.

The company had been expecting the cyber criminals to publish part of the stolen data on Tuesday, but nothing is still happening.

The company said it has been conducting a review of the security of its architecture and announced new IT security measures.

“As you would rightly expect, we’re working closely with specialist police teams and data security experts to do all we can to best understand the incident and what we can do to protect our clients now and in the future,” said Andi Case, CEO of Clarkson. “We hope that, in time, we can share the lessons learned with our clients to help stop them from becoming victims themselves. In the meantime, I hope our clients understand that we would not be held to ransom by criminals, and I would like to sincerely apologise for any concern this incident may have understandably raised.”

Bitcoin Gold (BTG) dev team warns its users about a security breach

29.11.2017 securityaffairs Incindent

The development team of the Bitcoin Gold (BTG) cryptocurrency is warning all users users about a security breach involving its Windows version of wallet app

The development team of the Bitcoin Gold (BTG) cryptocurrency is warning all users users about a security breach involving the official Windows wallet application offered for download via its official website. Bitcoin Gold is the fork of the official Bitcoin cryptocurrency that was created on October 25.

The Bitcoin Gold website does not include links to the installers for the official wallet apps, but links to files hosted in a GitHub repository used by the development team